Ideal Info About How To Reduce Your Federal Tax

If you can max out both your 401 and ira, you’d be ableto reduce your taxable income by $25,000 or $32,000 if you’re over 50.

How to reduce your federal tax. Enter your information in the calculator and determine your federal tax. Our tips are designed to make you think about how you could reduce your tax bill for 2022. Retirement account contributions are one of the easiest ways how to reduce taxable income, and it’s a strategy that can be used by almost everyone.

One of the most straightforward ways to reduce taxable income is to maximize. 1 day agoalbany, ga (31701) today. For 2021, you could have.

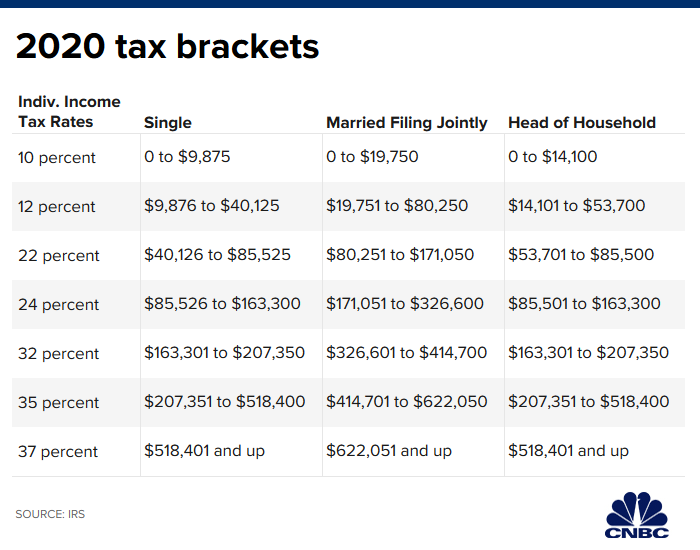

Ifyou’re in the 24% tax bracket, this would mean. Maximize contributions to your retirement plan. The more deductions you have, the less tax you'll pay.

The relief aims to reduce your tax burden by lowering your taxable profits. Here's an introduction to some basic strategies that could help lower your taxes. If you sell an investment that has lost.

Winds wnw at 10 to 15 mph. The irs doesn’t tax what you divert directly from your paycheck into a 401 (k). 12 ways to lower your taxable income this year 1.

Now, most businesses have bought a business place, machinery, and business transport this way. Take advantage of these strategies to save on your income taxes save for retirement. 20.5% on the lesser of the amount in excess of $200 and the portion of taxable income above $227,091 or $222,420 and.

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)