Amazing Info About How To Avoid The Estate Tax

Luckily, we have several relatively inexpensive tools that we can use to legally avoid much or all of the estate tax that would otherwise be imposed on your estate.

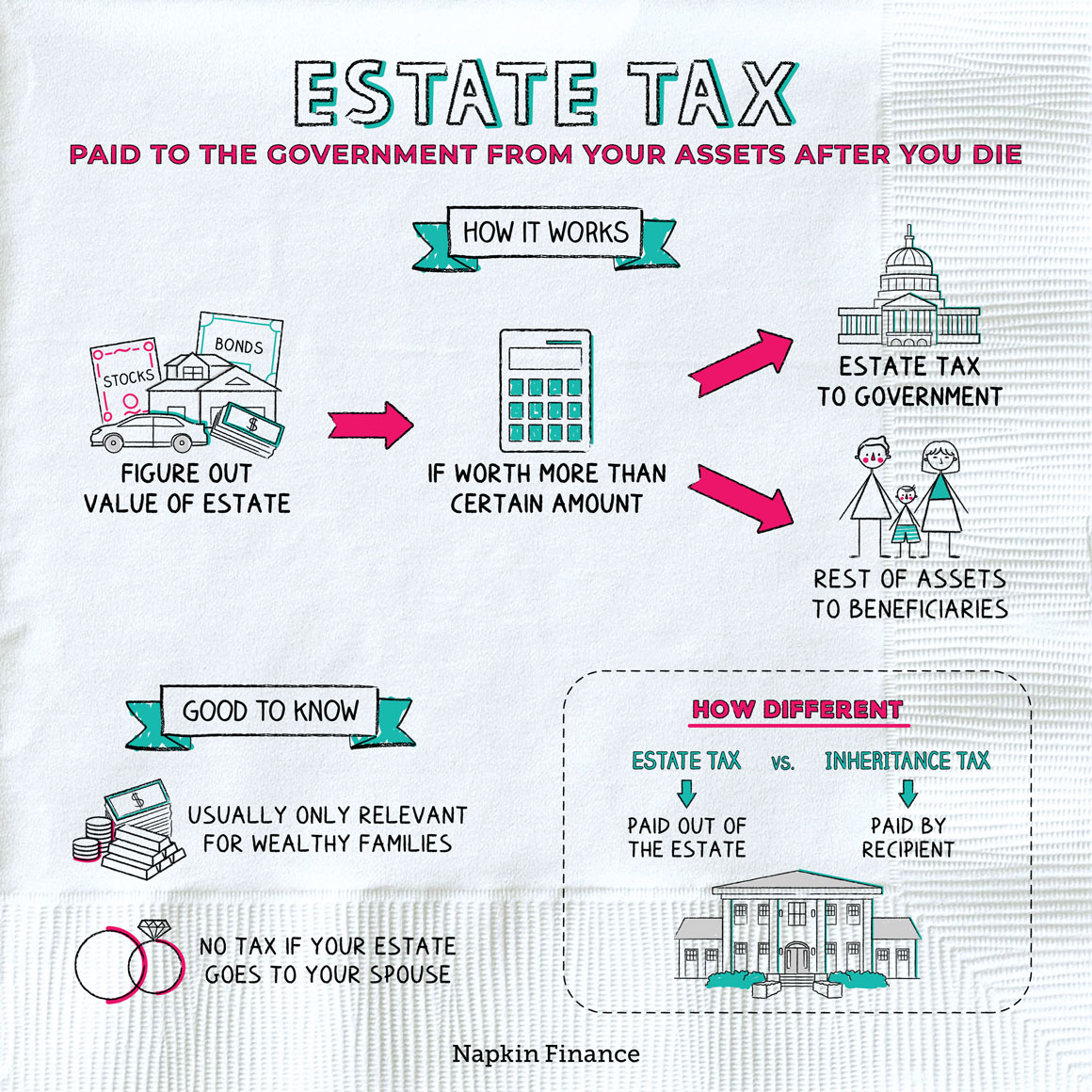

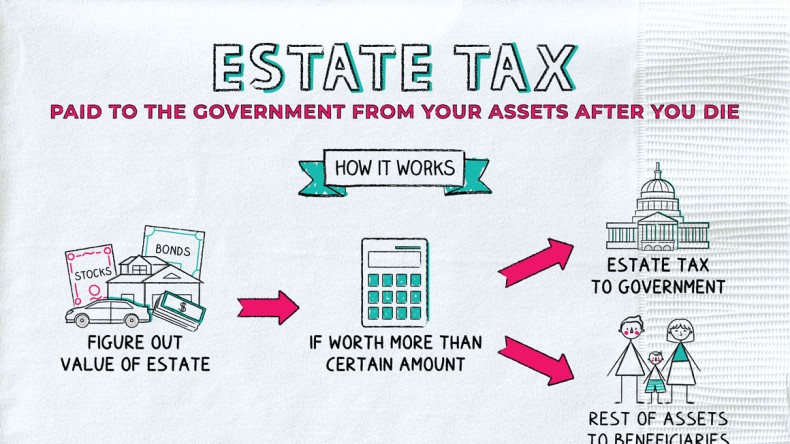

How to avoid the estate tax. Limiting your assets can help avoid estate taxes the fewer assets you have, the less there is to tax. Download inheritance tax planning handbook 2021 2022 book in pdf, epub and kindle. Understanding the differences between estate taxes & inheritance taxes.

Thousand oaks, ca home menu. In 2022, the federal estate and gift. Spending assets is a surefire way to reduce the value of an estate and reduce estate tax liability.

One way to reduce estate tax is by transferring your assets. It is your right to protest your real estate tax valuation. Be careful about giving stock or real estate away.

An irrevocable trust can be a handy way to avoid estate taxes if your estate is large enough to be potentially liable for them, at both the state and federal levels. To avoid (or at least minimize) the massachusetts estate tax, there are 4 estate tax planning strategies that are commonly employed by my clients: City council declared level 4 water conservation measures learn more here

Strategies to avoid estate tax. Buy life insurance now and use the benefit to pay the tax 2. While you may not be able to avoid estate taxes altogether, you can limit.

However, before beginning a long procedure, maybe you ought to reduce the assessment to dollars. First things first, make sure you know the difference between the estate tax and the inheritance. If your taxable income is $496,600 or more, the capital gains rate increases to 20%.

![Top Five Strategies For Avoiding Estate Taxes [Infographic] | Indianapolis Estate Planning Attorneys](https://frankkraft.com/wp-content/uploads/2013/09/Top-Five-Strategies-for-Avoiding-Estate-Taxes.jpg)